Updated April 13, 2021

Australian vets have seen a steady rise in pets being insured. However, up to now, that has not been matched by any increase in choice. Now we have a third entrant.

But you say, what about all these other pet insurance companies?

- RSPCA

- Bow Wow Meow

- Woolworths

- BUPA

- AAMI

- Medibank

- Guide Dogs

- PetBarn

- Petsy

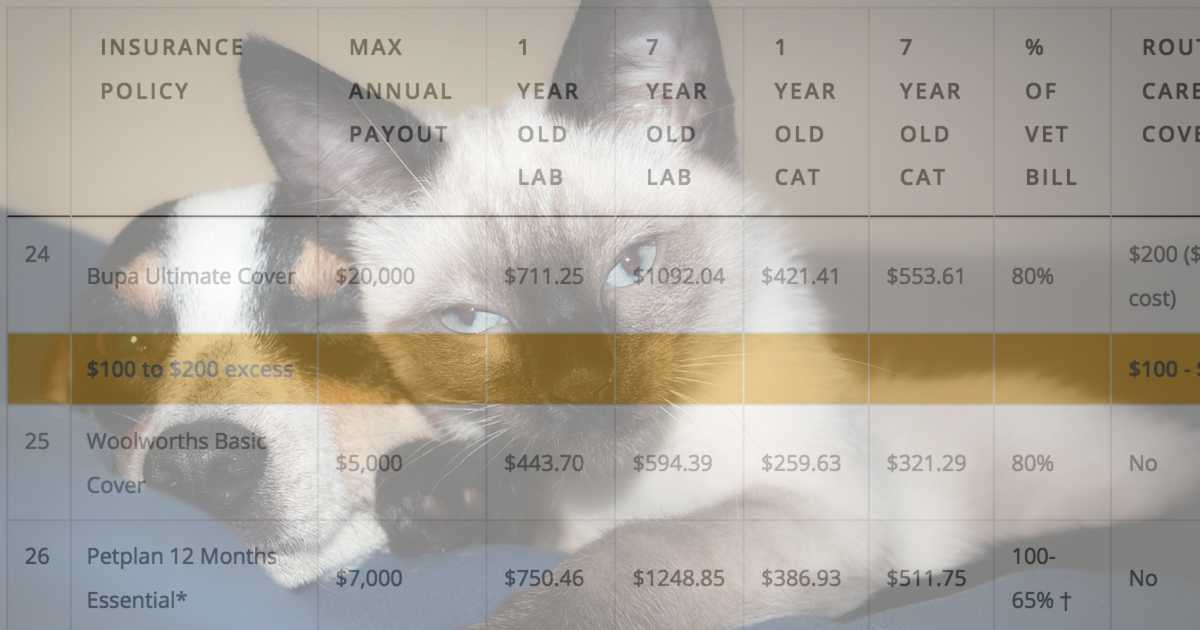

In fact, at last count there are 30 of these. The truth is that although they offer a genuine product, their terms and conditions are all very similar. That’s because they’re all underwritten by the same insurer, Hollard.

When they differ, it’s over things like:

- The excess amount

- The percent covered

- The maximum amount paid per year

- Whether they cover dentistry, alternative medicines or home visits

- Whether they cover routine vaccinations and other preventions

That’s still a reasonable choice, and enough for most people. It’s just that most of their rules are the same. For example, they all seem to have the same payout limit on consultations, cruciate ligament surgery and paralysis tick treatment.

Knose: The New Kid On The Block

Into the mix comes Knose, a company that’s been around in the vet industry for a while. This year they’ve started offering dog and cat insurance underwritten by Allied World. Here’s what they offer:

- a choice of percent covered between 70, 80 & 90%

- a $25,000 annual payout limit

- no excess

- emergency pet boarding if you are hospitalised

This compares well with the market.

- 90% cover is much higher than the average elsewhere

- $25,000 is a very high annual limit, almost certainly sufficient for every need

- Not having an excess is great for being able to make small claims, however it’s not unusual elsewhere

- Emergency pet boarding is good, but quite common elsewhere too

Knose claim to be offering a genuine difference to existing pet insurance policies. Where this is true is mainly in the lack of sub-limits for certain conditions. Other companies (except PetPlan) set limits on payouts for tick paralysis, some orthopaedic conditions and consultation fees.

This is especially useful for larger breeds of dogs prone to cruciate ligament rupture, who benefit most from TPLO surgery. It’s also great for dogs and cats living in areas known for tick paralysis, and for frequent attenders of the vet.

Knose also offer an option to pay less and not get cover for consultation fees. One other quirky difference is that Knose will cover a pet for up to 60 days when on holiday in New Zealand. This seems quite niche, but it must be great for some.

Knose Cost Comparison

RSPCA offer a no excess policy with a $20,000 limit, and BowWowMeow with a $15,000 limit. I did a quick comparison of the monthly fees…

| % Cover | With Consult | Minus Consult | vs BowWow | vs RSPCA |

| 70% | $51.39 | $46.31 | n/a | n/a |

| 80% | $58.38 | $53.29 | $60.11 | $66.20 |

| 90% | 66.76 | $60.98 | $72.79 | n/a |

On this quick look, Knose come up well. They give a higher payout, have fewer exclusions, and the monthly fee is less. However, it’s up to you to compare the policies carefully.

Just like the others, Knose don’t cover routine dental problems or alternative medicines. Neither do they cover all the usual exclusions like neglect, behavioural issues or diseases prevented by vaccination.

Most importantly, they don’t routinely cover pre-existing conditions, the biggest complaint about pet insurance made by Choice last year. I think the criticism was unfair, but there you go. Any disease your pet has had before the cover started is unlikely to be able to be paid out later.

Knose state that once you start cover you can apply for a free pre-existing condition assessment. What that may do is create a waiting period for this condition of 3 months to 3 years, depending on the case. Of course, problems that their vets see as likely to result in frequent future claims are unlikely to get this offer.

What About PetPlan?

There is another independent pet insurer in Australia. PetPlan actually cover more things than the other insurers, which you can read about in an older article. So why haven’t I mentioned them yet?

It’s because PetPlan have gone through some upheavals in the past few years accompanied by steep increases in premiums. This has caused a large exodus of customers and great unhappiness.

We heard recently that PetPlan are changing their name to Petcover and getting a new underwriter. One can only hope they will return to being a genuine competitor. We need all the choices we can get!

Which Pet Insurance Is Best?

Pet insurance is no scam. It works well for getting dogs and cats out of bad situations. I like it when you get it. but it’s totally your choice.

It’s up to you to decide what you want and if the fees provide value for money. I don’t think that Knose are earth-shatteringly different but they’ll suit some people better and may save some money for others.

In the end it comes down to what works best for you and your dog or cat. And I’m sorry to say that the only way you’ll know that is by some awfully dry reading. And by asking your vet: no one knows the hazards faced by your pet better than those who see them every day.

Have something to add? Comments (if open) will appear within 24 hours.

By Andrew Spanner BVSc(Hons) MVetStud, a vet in Adelaide, Australia. Meet his team here.

Buyer beware, I purchased Knose insurance for my 2 dogs and just got my renewal and its gone up 25%. I have made no claims and was told its due to other customers making too many claims. I should of listened to the person who warned about the same thing on a review page warning of Knose ridiculous price increases

I am with Knose.

My only negative comment would be the length of time it takes to receive confirmation that a claim has been approved.

I have made 2 claims in 2 years.

Once for anaphylactic shock after a bee sting in my dogs mouth, and another for an anal gland abscess.

Both were after hours emergency consults and both times I have waited well over 4 weeks to be reimbursed my 90%.

I could actually claim my normal consultations as well because I have this included in my policy, but to be honest, it feels like I should pick my battles wisely in case after a few claims I am black marked, and not covered at a time when it is most urgent.

The point of insurance is so u don’t have to be out of pocket in an emergency.

I know this isn’t a GAP only insurer, but if my dog needed surgery that was going to cost me $3500, I wouldn’t be able to cover it because more than 4 weeks to be reimbursed will pretty much see me evicted.

I’d have to use my rent to cover it and I’d be behind for long enough to be shown the door to homelessville.

So the cover looks good on paper but unless u have Ur own funds available to u in an emergency, the cover is almost pointless because more than 4 weeks for approval is too nerve racking. Too much uncertainty.

Oh and also, after the first 12 months, my premiums increased from 140/ Month to 185.

This is only after 1 claim under $500.

I understand the premiums go up as the dog ages, but I felt tricked with such an increase after just 12 months.

Hope this is helpful.

Hi Andrew,

I have a cavoodle who is 4.5 months old. From what I have read, they are not as prone to as many orthopaedic type issues… especially within the 6 month waiting period.

Would Knose be a suitable insurance company for my breed? ( Not that you can favour organisations, but knowing what they do and don’t cover)

Thank you

Lisa

Hi Lisa. As you say, I am limited in what I can say, but I can see no problem with using Knose.

Very disappointed in Knose. I am a pensioner and purchased Knose insurance thinking my toy poodle would be looked after should the need arise. So angry that I got insurance for my 12 week old baby, thinking I would be covered for anything and now I am in a dire predicament. Contemplating putting her to sleep as I just cannot afford that type of expense to have her knees fixed. Not a very ethical business. I would suggest the people who word your documents are not animal lovers at all – just in it for the bucks. Hereditary issues are there at birth and you say you cover hereditary issues. Just so upset.

Hi Angela. Just to be clear, we are in no way affiliated with Knose pet insurance. Your comments are interesting, and I’m assuming (given the breed) that your dog has medial patella luxation. I am surprised that this is not covered as I am used to people having the surgery done under insurance (see current costs here). In the case of MPL, it’s really a developmental disease with strong breed associations so even if they say it’s genetic or hereditary, a letter from your vet might sort them out. My general view about insurance is that you often have to push a bit to get them to see it your way. Is it possible that you are in the 6-month orthopaedic conditions waiting period? (pet owners can have this waived with a letter from their vet by the way). I would love to know more. And by the way, there’s almost no cause for euthanasia for MPL unless it’s at the most severe end of the spectrum (these however are usually symptomatic well before 12 weeks of age).

If your dog breed is prone to hip dysplasia, just be aware that Knose does not cover hip replacements.

Thanks Colin. Owners of breeds that can be severely affected (e.g. Rottweiler, Samoyed) would be wise to read the fine print on their plan before signing up. It’s probably worth mentioning that hip replacements are very rarely done in Australian dogs, athough there are plenty who would benefit. It just might be that vets aren’t recommending the procedure early enough.